Here is an explanation of the Israeli payslip for the perplexed: Broken down into color-coded sections. This article was a guest post I wrote for www.israemploy.net in 2010.

Here is an explanation of the Israeli payslip for the perplexed: Broken down into color-coded sections. This article was a guest post I wrote for www.israemploy.net in 2010.

http://www.israemploy.net/The_Israeli_Pay_Slip_/

The Israeli Pay Slip – An in-depth Explanation for the Perplexed

For those of you that are working in Israel, or have worked in the past, trying to decipher your pay slip is one of the most complicated things you will experience in the workplace, right up there with understanding how to use the coffee machine.

We are fortunate to have Moshe Egal-Tal available to provide us with a comprehensive article about the intricacies of the pay slip, so that you can better determine how you are being compensated, and confirm that there are no mistakes.

As with most things, payroll is much more complicated in Israel than in other countries. In January 2009 a new law was passed to ensure uniform mandatory information that must be specified on all pay slips.

All of the payroll programs in Israel (which generate the pay slips) must be approved by the tax authority that they meet the mandatory requirements as defined by laws and regulations. Regardless of the program your employer uses, all the programs have common attributes. The layout and placement will differ a bit from program to program, but there are basic requirements that are mandated by law. The purpose of this article is to familiarize you with the terminology and help you understand what is printed on your pay slip. For those of you working, it is highly advised to examine your pay slip each month in order to ensure that there are no mistakes. Understanding what was paid/deducted from your pay is critical and to your benefit.

There are payroll programs for the PC that are off-the-shelf software (as is) that are commonly used by small employers / CPA offices who run payroll for their clients. There are also more complex programs that use a large number of variables that are user-defined by the employer. These programs are usually used by medium-sized and large companies. The PC programs generally allow printing pay slips on plain paper or pre-printed forms, which are more costly and as a result many employers are reluctant to use them. A plain paper pay slip is legal as long as it contains all the data required by law and as long as it is signed and has the company stamp on it.

The Makeup of the Pay Slip

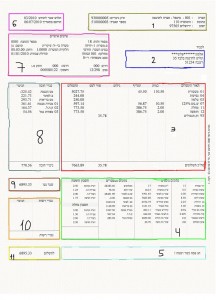

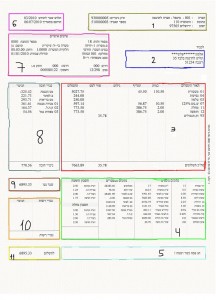

The Israeli pay slip is made up of several sections (see Appendix for example):

· Specific information (header)

· Payments (tashlumim)

· Mandatory deductions (nikuei chova)

· Voluntary deductions / commitments (nikuei reshut / hitcheivuyot)

· Informatory information / accumulated sums (meida klali / mitstabrim)

The Specific Information Section (or header) (see sections #1, #2, and #7 on the demo payslip below) contains the employee’s name and will usually contain the name and/or number of the department/project where the employee works. Typically the employee number is also listed and the employee’s teudat zehut number and home address.

The pay period is also listed, for example: March 2010. The employer’s name, address and tax identification number and the employee’s bank account details and start date. If you work in the public sector, you will also have your pay table and rank listed as well as your % of position (full-time [100%] or part-time). There will also be a detailed account of your vacation and sick days; balance at start of pay period, credit for the pay period, debit for the pay period (how much you utilized) and your new balance.

The Payments Section (see #3 in red on the demo pay slip below) contains an itemized breakdown of all the components paid to the employee for the pay period. For example; Base pay, travel expenses, overtime hours, etc. Also in this section will be any tax value components (Holiday gift, company car or any other benefit that isn’t paid in money). The total gross pay will also be listed at the bottom of this section.

The Mandatory Deductions Section (see #8 in light blue on the demo pay slip below) contains an itemized breakdown of all deductions that are mandatory by law.

For example; Income tax, Social security, Health tax and mandatory pension payments. These are the employee’s part and as such are deducted from the total gross pay. The total of all the mandatory deductions will also be listed.

Some programs have added underneath the itemized breakdown of mandatory deductions, the employer’s part for any pension or savings funds or health insurance that the employee is entitled to. Other programs detail this in the informatory information section. The law stipulates that this must be detailed on the pay slip, but not necessarily where. It is usually categorized with an underlined or bolded headline or in a pre-printed field.

The Voluntary Deductions Section (see #10 in orange on the demo pay slip below) contains an itemized breakdown of all deductions that are voluntary.

For example; advances on payroll, repayment of loans to employer, charges for purchases to employees from a company store/collective purchase, payment for subsidized vacation or any other social or cultural events sponsored by or promoted by the employer which entail a cost to the employee or money deducted from an employee for loss or damage to equipment. The total of all the voluntary deductions will also be listed. This total amount is also deducted from the total gross pay.

The Informatory Information Section (see #4 in bright green on the demo pay slip below) will contain the monthly gross pay for tax and social security purposes and the monthly gross base pay for pension.

This section also will contain various informative details: total accumulative gross pay for the current tax year, number of actual days worked in the pay period, total number of potential work days in the pay period, the employer’s tenure is usually listed here as well. The employee’s tax credits as well as the value for each credit will be listed as well as a detailed account if there are any special tax benefits (oleh chadash, discharged soldier, national precedence area, etc) or a tax coordination was done.

The footer of the Pay Slip (see #4 in bright green on the demo pay slip below) {note: On this payslip this section is incorporated as part of the Informatory section} will contain the amount of days for tax purposes for each of the months worked. Monthly salaried employees will see 25 for each month worked, although there are payroll programs that put a check mark near each month worked.

The employee’s marital status and number of children under 19 years old will also show up here or in the specific information section. The employee’s marginal tax percentage and the accumulative amounts for the employee’s part of each of the funds/savings plans and whether the employee’s spouse is employed or not is included as well.

The minimum wage must also be listed (monthly and hourly rates). This section will usually have the total gross pay, total deduction, net pay, total voluntary deductions and pay in the bank listed.

Income Tax (will show up in section #8 in light blue, on the demo pay slip below)

The 2010 tax brackets are as follows:

Up to:

4,590 shekels 10%

8,160 shekels 14%

12,250 shekels 23%

17,600 shekels 30%

37,890 shekels 33%

Every additional shekel 45%

The tax is configured anew each month on an yearly-accumulative basis which takes into account all payments paid by the employer since January of the current year and after configuring the tax, the accumulative amount of tax that was paid is deducted and the remainder is the tax for the current month.

This is easily explained via the following example: for the first 3 months an employee earns the same gross pay. In the 4th month he receives a 3,000 shekel bonus. Obviously this will raise his taxes for this month. Occasionally, employees receive a tax rebate on their payslip via the form of a negative sum of tax.

Tax Credits/Points

All employees are eligible for tax credits (each worth 205 shekels – JAN 2010). The tax credits are allotted as follows: Every employee 2.25 points, Female employees an additional 0.50 points Single parents who have care of children under 19 get an additional point for each child and a half of a point for children the year they were born or the year they turn 19. There are other instances where employees may be eligible for extra tax points, but these may be given by the employer only upon written instruction by the tax authorities. Examples are: handicapped children, invalids, crippled or blind employees.

Consult the Israel Tax Authority’s web site for more information: (the total # of tax points will show up in section #4 in green on the demo pay slip below)

Social Security (Bituach Leumi) (will show up in section #8 in light blue, on the demo pay slip below)

Social security is mandatory for all female employees between 18 – 62 and male employees between 18 – 65. There is an employer’s portion and an employee’s portion. The money insures an employee against bankruptcy of the employer, reserve army duty, unemployment, old-age stipends, work-related accidents, just to name a few. For the first 4,806 shekels the rate for the employee is 0.4%, anything over this is calculated at 7%.

Mandatory Pension (will show up in section #8 in light blue, on the demo pay slip below)

The mandatory pension law went into effect in Jan 2008. All employees who either have an existing “live” pension plan from a previous employer or anyone with tenure of 6 months are eligible for pension. In 2010, the rates are: 2.5% employee, 2.5% employer and 2.5% severance pay (employer). The employee’s contribution is deducted from his payslip and must be deposited to the fund of the employee’s choosing.

Appendix

Explanation of the Above Demo Pay Slip: (click on the image to enlarge it)

1. Employer’s Information (name, address, tax i.d. #)

2. Employee’s Name and Address

3. Payments Section (itemized and total of all gross payments)

4. Additional Information, annual accrued totals and vacation and sick pay balances

5. Space reserved for notice to all employees such as “happy Holiday” (see example above), or personalized message for specific employee(s) such as “Happy Birthday”

6. Information Regarding this Pay Slip (the pay period and date the pay slip was printed)

7. Personal Information (Israeli ID #, basis of employment (monthly/hourly), bank account details, tenure, start date, marital status, etc)

8. Mandatory Deductions (itemized and total)

9. Net pay (prior to voluntary deductions)

10. Voluntary Deductions (itemized and total)

11. Net Sum Transferred to Employee (bank account/check)

Like this:

Like Loading...

Here is an explanation of the Israeli payslip for the perplexed: Broken down into color-coded sections. This article was a guest post I wrote for www.israemploy.net in 2010.

Here is an explanation of the Israeli payslip for the perplexed: Broken down into color-coded sections. This article was a guest post I wrote for www.israemploy.net in 2010.