In the past I have been asked many times whether sending a payslip via email or posting it on a website is legal. It never reached the court system for a ruling, but the lawmakers, realizing the advances in technology, addressed the issue by updating a new statute in the protection of salary law.

In the past I have been asked many times whether sending a payslip via email or posting it on a website is legal. It never reached the court system for a ruling, but the lawmakers, realizing the advances in technology, addressed the issue by updating a new statute in the protection of salary law.

On July 26, 2017 a new statute was added to the protection of salary law (special ways to hand out payslips) was publicized in the records thus making it officially part of the law. The statute states:

An employer may hand out payslips by one or more of the following special ways detailed below, in place of printed payslips;

1. Via secure internet site on the employer’s behalf * to which an employee may access with initial password supplied by the employer, whereby the employee can view his payslip.

* An “internet site on the employer’s behalf” is a site that serves the employer and the following two conditions are met:

A. Allows access to the data saved on it after the employee has been personally identified.

B. Protective measures are taken, on a regular basis, against unauthorized penetration and disruption of proper useage.

2. Sending the employee’s payslip to an email address provided by the employer (work email) via an email program.

3. Sending the employee’s payslip to the employee’s private email address.

-

The conditions under which this statute apply are:

1. The employee agrees and signs written consent to waive receipt of printed payslip via waiver form (see below).

2. The payslip can be printed at anytime in the future upon demand.

An employee can retract this consent at any time in the future, in writting, including email notification and the employer will act accordingly from the month after the notification is received.

The payslip, issued in one of the above special methods, the following directives shall apply:

1. Issuing the payslip will be done by the determined date (the date salaries are deposited in the bank).

2. In case of sending payslip to the employee’s personal email address – the employee shall acknowledge receipt, in writting (reply email) shortly after receiving the payslip, and no later than 5 days after the determined date, that

he has received the payslip.

3. An employer who has not received email confirmation from an employee acknowledging receipt of the payslip within 5 days of the determined date will issue a printed payslip no later than 10 days after the determined date.

An employer who issues the employee’s payslip in one of the special ways described above will enable the employee to receive a printed payslip, upon request, for a period of no less than 7 years from the determined date for supplying the employee a payslip according to law.

An employer who issues payslips via secure internet site, via employee access with password shall allow access to payslips for a minimum period of 12 months from the determined date for supplying the employee a payslip according to law.

The employer is required to take protective measures that will not allow changes to the payslips that are issued according to this statute.

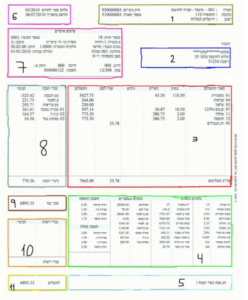

The following is an English language wording of the form that needs to be signed by the employee. Note this a legal document and the employer should keep the signed form in the employee’s file.

Form of consent to receive payslips via electronic media

-

Part A

Employee’s name ____________________ Israeli I.D. # ________________________

Name of employer _____________________ Place of work (location) _____________________________

Email address to which payslips will be sent or address of employer’s site to which payslips will be accessable ______________________________________

Employee will choose the method he prefers and check the applicable box accordingly.

I, the undersigned whose details appear above hereby give my consent to receive my payslip for my work in the manner specified below and I am aware that by doing so I waive my right to receive a printed payslip on the determined date according to the law, however I will retain access to the payslip according to statute 3 (A)

[ ] 1. Sent to my email address in the employer’s email system as listed above.

[ ] 2. Via a secure website on the employer’s behalf, accessable by personal password. The site address and password have been provided to me by the employer.

[ ] 3. Sent to my personal email address as listed above.

Note: the employer may erase two of the three options above allowing only one of the options, but he may not erase option 4 below !!

[ ] 4. I, the undersigned whose details appear above do not agree to receive my payslip for my work via electronic methods in any of the 3 options above. I hereby request receipt of a printed payslip each month by the determined date according to the law.

-

Part B

This section is to be filled out and signed by the employee only when option 3 above has been chosen as the method in which the employee will receive his payslip.

1. The private email address above has been given to the employer by me and with my consent. I hereby state that this email address is in my own personal use.

Employee’s signature ________________________________ Date __________________________

I have chosen the option to receive my payslip via my personal email address (option # 3), my consent to receive my payslip via this option is with my understanding of all of the following:

1. I am aware that external email systems and accounts are not under the employer’s control.

2. Receiving this form to fill out and sign is the employer’s obligation to take all reasonable measures to ensure that access to my payslips and viewing the information on them will be done soley by me, or with my permission, and at the least the employer has taken measures for encoding the data in order to protect my privacy.

3. Despite the above, I am aware of all of the following:

A. I agree that my payslips be sent to an external email system and the data may be exposed to third parties, amongst them the service provider of the external email service.

B. There is no guarantee that the external email system contains protective measures from hackers, unapproved access and disruption of functionality.

C. It is possible that the data will be lost, not be saved or will not reach the desired destination due to circumstances that are not under the employer’s control.

D. It is possible that the data is stored outside of the borders of the country of Israel and this may have an impact on my rights regarding the usage of the data.

E. I am aware that it is highly recommended that I personally save and backup the payslips that are sent to me via this option.

F. This consent of mine is in effect from now on and until further written notification by me that I have rescinded my consent.

Employee’s signature ________________________________ Date __________________________

Note: This is not legal advice, nor is it meant to be. The purpose of this post is to enhance employee and employer awareness to this addition to the protection of salary law.

The wording is my own and not a literal translation. In any case of contradiction between this post and the law, obviously the wording of the law applies. Employers may use the wording of the above by copying the wording into a word document.