Are you a salaried employee or self-employed ?

There is a huge difference ! Not only in the benefits you are entitled to, but in regard to your responsibilities. No, I am not talking about your social benefits or your salary. I am talking about Social Security (or Bituach Leumi as it is known in Israel). Before you say that of course you know what your status is, I suggest you read this post through to the end. It may have some eye-opening surprises for you that can have serious impact on you, financially.

Many people own companies or are suppliers of services as self-employed. There are people who work legitimately as salaried employees, and some do a little of both.

Others have start-ups they run from home: anything from selling things, to doing work over the computer, whether it be building internet sites or translating work, or whatever. It is this last group that this post is targeting.

First, it is important to understand that while both self-employed and salaried employees pay Social Security, the rates are different and so is the coverage for various stipends as well as the base amounts for the stipends.

If you are considered by Bituach Leumi to be self-employed, but you are reported on a company’s payroll (not a placement or manpower agency), that fact does not make you a salaried employee. What counts is your actual status. Bituach Leumi, by law, can change a person’s status one-sidedly and even retroactively ! As a result of such a change they can demand back payment at the rates that existed for self-employed persons ! If you received in the past, during the said changed period, a stipend from Bituach Leumi, your eligibility for that stipend may be re-evaluated and even disallowed.

Recently, a verdict was released by the labor court in a case of “stage and communication ltd” and others vs. Bituach Leumi (case # 5062/06). Bituach Leumi one-sidedly changed the status of certain “employees” in the company. The company and the employees filed suit in labor court contesting the change.

The court, asked the simple basic question “did employee-employer relations exist between certain employees who were on the company’s payroll as salaried employees and reported as such ?”. The verdict explicitly stated that there were no such relations and these “employees” should have been reported as self-employed for all purposes.

The Judge stated in his verdict the following: “The model of employment, which all of the plaintiff companies involved in the suit, used was in actuality a front. These companies only designation was to relieve self-employed people from the burden of managing their affairs with the tax authorities and the defendant (Bituach Leumi). There is no relationship or connection between the plaintiff companies and the services the employees, who were reported as salaried workers, provided to the recipients of the services. The only reason the employees were on payroll as salaried employees was to avoid having to manage their affairs with the authorities.”

This is a precedent setting, important verdict, the first of it’s kind, in a very lengthy case.

This is how you can check yourself to see if you qualify as a salaried employee or as a self-employed person

Answer the following questions truthfully. If your answer to any of these questions is negative, this very well could mean that you are self-employed:

1. Is there someone who arranges your schedule at work ?

2. Is there someone at work who assigns or re-assigns you to a project/position ?

3. Is there someone at work who has the power and authority to fire you and terminate your job ?

4, Is there someone at work that you need to request vacation leave from ? Or to notify regarding tardiness, sick days, reserve army duty, etc ?

5. Is there anyone at work who supervises your work and you report to as a superior ?

6. Is there any type of time-sheet reporting and follow-up for your work hours and days ?

and if your answer to any of these questions is positive this very well could mean that you are self-employed:

7. Do you decide which clients/ jobs to accept and which to reject ?

8. Do you negotiate with clients the price they will pay or determine the cost for jobs ?

9. Are your wages implemented by sharp up and down changes due to the cash inflow that you receive from third parties ? And as a result is it difficult to point out your monthly base pay ?

10. Is payment of your wages delayed until the amount is received in full from a third party ? (not paid on a set date)

If the answer to these questions is negative, chances are you are not eligible to be a salaried employee. You need to register as a self-employed individual at your local Bituach Leumi office in order to ensure your rights. Don’t wait for them to rescind your salaried employee’s rights retroactively. More information can be found on Bituach Leumi’s website: www.btl.gov.il

This is not something to be taken lightly !

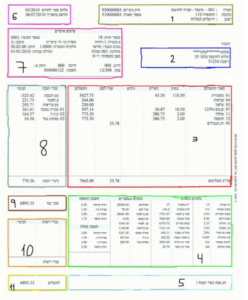

In the past I have been asked many times whether sending a payslip via email or posting it on a website is legal. It never reached the court system for a ruling, but the lawmakers, realizing the advances in technology, addressed the issue by updating a new statute in the protection of salary law.

In the past I have been asked many times whether sending a payslip via email or posting it on a website is legal. It never reached the court system for a ruling, but the lawmakers, realizing the advances in technology, addressed the issue by updating a new statute in the protection of salary law.